Send a message.

We’re here to answer any question you may have.

We’re here to answer any question you may have.

30 Speakers From

Around the World

September 10th 2024

September 12th 2024

New York

Houston

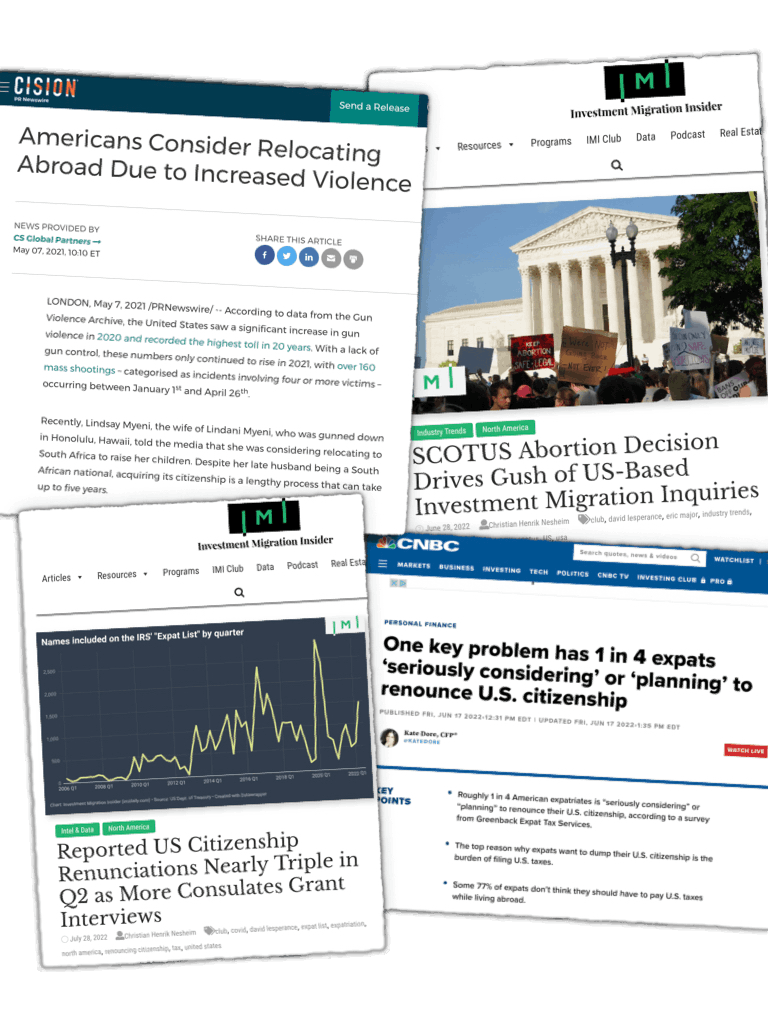

American families, entrepreneurs, and HNWI have become disillusioned with the American Dream. Political polarization, high taxation, gun violence, and anti-abortion laws have pushed droves of wealthy Americans to the brink. With their livelihoods, safety, and rights at stake, Americans are looking overseas for the freedoms in life and in business that they once found in America. The America Outbound Summit has been designed exclusively to connect the wealthy individuals and advisors of HNW American families with overseas providers of investment migration, real estate, tax planning, and wealth planning services.

The Administration ended the COVID-19 vaccine requirements for international air travelers at midnight on May 11, 2023, the same day that the COVID-19 public health emergency ended. This means starting May 12, 2023, noncitizen nonimmigrant air passengers no longer need to show proof of being fully vaccinated with an accepted COVID-19 vaccine to board a flight to the United States. For more information, please log on to the webpage of the Department of State.

Generally, a citizen of a foreign country who wishes to enter the United States must first obtain a visa, either a nonimmigrant visa for a temporary stay, or an immigrant visa for permanent residence. Visitor visas are nonimmigrant visas for persons who want to enter the United States temporarily for business (visa category B-1), for tourism (visa category B-2), or for a combination of both purposes (B-1/B-2).

There are several steps to apply for a visa. The order of these steps and how you complete them may vary by U.S. Embassy or Consulate. Please consult the instructions on the U.S. Embassy or Consulate website.

For more information on how to apply for or renew a U.S. tourist visa, please log on the U.S. government’s official website.

Jay Conference Bryant Park

Address 104 West 40th St, New York, NY 10018

https://goo.gl/maps/Uyeu5G2455ZF1bCX8

Sofitel Los Angeles at Beverly Hills

Address 8555 Beverly Blvd. CA 90048 Los Angeles

https://www.sofitel-los-angeles.com/

The Sofitel Los Angeles at Beverly Hills is a luxury urban resort hotel & spa featuring a rooftop pool, an outdoor garden patio and a trendy bar with craft cocktails, delicious bar bites and famous daily entertainment from Jazz to Salsa. It is located across of the street of L.A. largest shopping mall the Beverly Center, within 2mi of Rodeo Dr, Sunset Blvd, the Grove & the Academy Museum.

Gold

Lunch

Silver

Bronze

Networking

Patron

Exhibition

Digital

Supporting Organization

Angelo Robles

Founder and Chief Executive Officer

Family Office Association

Angelo Robles knows a thing or two about wealthy families. He’s been working with them since 2008 when he founded Family Office Association, a global membership organization for UHNW families and their family offices. His members say that he delivers the finest in content and programming, including his own proprietary content on designing, accelerating and/or transforming single family offices to thrive generationally. Angelo emphasizes embracing innovation in the single family office. This includes creating appropriate benchmarks, implementing relevant technology, and updating processes to align with industry best practices.

Having worked with multiple generations of families for the past 12 years and their trusted advisors, Angelo has gained an enormous amount of intellectual capital on how UHNW families think and feel — and what motivates them.

Angelo is the founder of the Effective Family Office think tank and is creator of the “Family Office Masterclass Program Series” for families, their single family offices and their advisors. He also personally coaches a select group of global families and advisors.

He is a frequent source to top media outlets like Bloomberg News, Wall Street Journal and Institutional Investor, and maintains a thought-leadership series via his podcast The Angelo Robles Podcast on Apple Podcast, Spotify and other platforms. He has also authored the book Effective Family Office: Best Practices and Beyond, which is available through Amazon. He is the co-author of Maximizing Your Single Family Office: Leveraging the Power of Outsourcing and Stress Testing.

As the founder and CEO of SFO Continuity & FamilyOffice TV, he focuses on helping families and their SFOs achieve family continuity in the face of a myriad of risks, vulnerabilities and distractions within and outside the family.

Russel Morgan

Principal and Founding Partner

Morgan Legal Group

Russel prides himself on his passion and advice to families, Chief Executive Officers of major corporations, high net worth individuals, multinational corporations, closely-held business owners, as well as all types of entrepreneurs and charitable organizations.

Russel Morgan, the company’s founder, guides you through strategies engaged with reports like wills, trusts, and beneficiaries. There are many more benefits to an estate plan. Moreover, in preparing for future issues, it’s essential to plan beforehand while keeping the importance of your home and family.

Russel is a graduate of New York Law School, LLOYD’S of London, and is admitted to practice in New York.

Yiannos Trisokka

Group CEO & Founder

Velment

Yiannos has served as the Managing Partner, Member of the Management Board, and Chairman of the Real Estate Committee of international companies operating in the investment migration industry.

For the past two decades, he has been entrenched in the real estate market of Cyprus and Greece. His comprehensive understanding of the market makes him a valuable consultant and partner to developers, estate agents, law firms, and financial services providers. This experience and his close cooperation with all stakeholders in this sector define him as an authoritative expert in the field. His track record spans every area of the real estate industry, from identifying plots that are suitable for development to consulting property developers in the design of desirable projects, serving investors, and delivering comprehensive after-sales services. He is also regarded as a specialist in identifying, handling, and managing distressed assets in a very resourceful way to achieve extraordinary win-win solutions for all parties involved.

Throughout his career, Yiannos has guided international investors, HNWI and ultra-HNWI to promising opportunities, often linked to citizenship via the Cyprus Investment Programme or Greece’s Golden Visa Programme.

Yiannos has been especially recognized for his ability to assess market offerings and balance them with investors’ needs. This understanding and appreciation of both sides of every transaction translate into profitable investment opportunities with realistic exit strategies that dovetail with each client’s individual financial planning.

Today Yiannos is the CEO and founder of Velment (https://velment.com/). With a presence in Cyprus, Vietnam, Greece, and Dubai, Velment specializes in serving an international clientele interested in investments in real estate linked to residency by investment programs around the world. Within that context, Velment offers comprehensive services, from buying and selling properties to after-sales services including property management and Real Estate Advisory services.

Koen Lozie

Managing Director

Aver Trustees Malta Limited

Koen Lozie is a Belgian international tax lawyer and certified European financial and estate planner. Among other degrees, he holds a Master’s degree from Georgetown Law School (D.C., 1991) where he specialized in U.S. international taxation and outbound US planning in particular. He is a member of the Society of Trust and Estate Planning Practitioners and the International Tax Planning Association. He also holds certifications in U.S. life insurance planning.

Most to all of his clients are expatriates, High Net Worth Individuals with roots in continental Europe, the Mediterranean, and Latin America. In the past, he has advised celebrities and their private bankers in Monaco, Switzerland, and Portugal. Among his clients, today are ultra-high net worth clients whereof several are on Forbes lists.

Before setting up his own firm he worked in tax in Belgium, with a private bank in Luxembourg and the Channel Islands and the Caribbean. Today he is active mainly from Malta from where he runs a regulated trustee company and manages private family foundations worldwide.

Being an expatriate and dual resident himself he has particular affinity and experience with migrating clients and families spread over several jurisdictions. He is a dual resident of Malta and Luxembourg and has an office in Zürich.

Cláudia Vasconcelos

Head of Business Development

NEWCO Corporate Services SA

Cláudia Vasconcelos is a Portuguese tax and immigration specialist, with more than three decades of experience assisting US and international clients investing in Portugal.

Cláudia started her career at the US Foreign Commercial Services in Lisbon and after 15 years working for the Madeira Island investment promotion agency, she joined NEWCO as Head of Business Development, dealing mostly with personal income tax, immigration, and corporate tax matters. NEWCO is a one-stop shop for international investors and expatriates in Portugal, with 30 years of experience and a full range of corporate, real estate, and relocation services.

Cláudia holds an undergraduate degree in International Relations, a Master’s in Business Administration, and Post-graduate Degrees in Taxation and Immigration Law. She speaks English, French, Spanish, and Italian.

Silvio Cilia

Founding Partner

Corrieri Cilia

Silvio Cilia is a Maltese warranted lawyer and founding partner at Corrieri Cilia. Silvio holds a doctorate in law from the University of Malta as well as an LL.M from Leiden International Tax Centre in the Netherlands. He also holds a diploma in trust law and administration.

Silvio is a specialist in international direct and indirect taxation, corporate, trust law, and immigration. His experience includes advising international corporate and private clients and families doing business or settling in Malta.

He also serves on the board of directors of a number of companies and collective investment schemes based in Malta. Silvio is a member of the International Fiscal Association, the Malta Institute of Financial Services Practitioners, the Chamber of Advocates of Malta and the Society of Trust and Estate Practitioners (STEP).

Derren Hayden Joseph

Partner

HTJ Tax

Derren has successfully completed the Comparative Tax Program at Harvard University and is an EA (Enrolled Agent). As an EA, he has been admitted to practice before the Internal Revenue Service (IRS) to represent taxpayers in all 50 states and internationally. He has 2 Masters Degrees in Economics and a Certified Diploma from the ACCA (Association of Chartered Certified Accountants in the UK).

Derren has also done Executive Education with Columbia Business School in New York City, and has completed Advanced Tax coursework at both New York University and the University of London.

He had his views published in the Singapore Business Review, Forbes Asia, and the American Chamber of Commerce in Indonesia, the International Business Structuring Association (in the UK), Offshore Alert, and the (Trinidad) Guardian. And has given “in person” seminars on tax issues in the U.S., the U.K., Singapore, Indonesia, Malaysia, Vietnam, The Philippines, Portugal, Hong Kong, the UAE, and the Caribbean.

Derren is currently a member of the Briefing Group advising The Rt. Hon. The Lord Mayor of the City of London on current and emerging international tax issues. Derren enjoys writing and has published 3 books on taxation, one of which was an Amazon Best Seller in 2020.

Geraldine Noel

Managing Partner

Acumum Legal & Advisory

Geraldine Noel is a highly experienced, award-winning barrister, licensed in the UK, Ireland and Malta, with over 30 years of experience in the legal field – including positions held in the UK, Switzerland, the USA, Malta, and the Cayman Islands. She has worked for private individuals, startups, and several multi-national companies and has a vast knowledge of private client, corporate, energy, tax, and tech law.

Geraldine obtained an LLM in US law from Fordham University of Law, NYC, where she lived and worked for 5 years – including holding a position at MetLife, NYC. Having obtained a US Green Card, Geraldine decided to return to Europe and moved to Malta where she renounced her rights to the US Green Card.

In Malta, Geraldine founded Acumum Legal & Advisory a boutique set of licensed legal, corporate, and trust companies. Geraldine is an Accredited Agent on behalf of the Maltese Government to represent clients in applications for Maltese citizenship services and all Maltese residency programs. Acumum also introduces clients to citizenship and residency programs in the EU and the Caribbean.

Leonardo Marques dos Santos

Partner

Miranda & Associados

Leonardo is a Professor of Tax Law and International Tax Law at the Portuguese Catholic University, where he teaches undergraduate, master’s, and postgraduate courses. He is a Partner at Miranda & Associates and a tax arbitrator at the Administrative Arbitration Center (CAAD).

Leonardo holds a Ph.D. in Tax Law from the Portuguese Catholic University, where he also graduated, obtained an LL.M. (Adv.) in International Tax Law from the International Tax Centre (Leiden University), and a Postgraduate Diploma in Taxation from the Instituto Superior de Gestão. His research agenda focuses, particularly, on the domestic and international taxation of charitable donations and non-profit organizations, as well as the taxation of individuals.

Julia Shamini Chase

Founder and Chief Executive Officer

Gold Leaf Consulting

Julia Shamini Chase is a trailblazing regulatory attorney and compliance specialist based in the British Virgin Islands (BVI). As the Founder and CEO of Gold Leaf Consulting Limited, Julia has established herself as a leading expert in legal regulatory services, compliance consulting, and innovative business solutions.

With an impressive track record, Julia has earned the trust and confidence of numerous renowned international financial services firms, fintech companies, and ultra-high-net-worth individuals. Her expertise lies in providing business-centric guidance, structuring solutions, and navigating complex regulatory landscapes. Her invaluable insights have been instrumental in assisting high-net-worth individuals across the USA, UK, UAE, and Europe, in establishing operating entities with lucrative cross-border operations and solutions utilizing BVI business companies and products.

Julia’s influence extends beyond legal and regulatory matters. Recognizing the comprehensive needs of her clients, she has also embraced the role of a primary family office consultant. By leveraging her extensive network, Julia ensures her clients have access to optimal banking solutions and can tap into leading experts in various jurisdictions Worldwide.

Julia’s relentless pursuit of excellence and her deep understanding of the ever-evolving financial landscape have made her a trusted advisor and a sought-after speaker at conferences and industry events. Her passion for her work and her commitment to providing tailored solutions to her clients are the driving forces behind her success.

Adenike Sicard

Consultant for Marketing and Business Development

BVI Finance

Adenike Sicard currently serves as a Consultant for Marketing and Business Development at BVI Finance. With over two decades of law practice within the British Virgin Islands financial services industry, she is a seasoned professional with expansive industry insight.

Throughout her career, Adenike has been an active participant in various local and international marketing and business development events. These have included BVI Finance roadshows, panel discussions, and forums held in cities across Asia, Latin America, Europe, and North America. Her participation aimed to enhance the BVI’s global presence and awareness.

Representing BVI Finance, Adenike connects clients with legal and service providers located within the BVI. Her extensive legal experience encompasses key practice areas integral to the financial services industry. This broad background, combined with her intimate knowledge of the field enables her to effectively promote the advantages of using BVI’s financial services and its available legal products.

Adenike has authored numerous articles on various financial services legislation in the BVI, showcasing her deep understanding of the industry’s regulatory landscape. She obtained her law degree from the University of the West Indies and a postgraduate diploma from the University of London.

Nuri Katz

Co-Founder and President

Apex Capital Partners Corp.

Nuri Katz is a 30-year veteran and leader in the investor immigration industry. He is a frequent commentator and contributor to global media outlets including the Wall Street Journal, New York Times, Financial Times, Bloomberg, CNBC, CBS, and many others. He frequently opines on subjects pertaining to immigration policy, government affairs, citizenship matters, international investment, tax policy, and more.

João Baptista

Chief Executive Officer and Co-Founder

Spark Capital Lda

João spearheads the investment management function at Celtis being the curator of the group’s portfolio. João is also the CEO and co-founder of the Spark Group.

He has several years of experience across the globe in various industries including finance, real estate and management consulting. João is a specialist in business strategy with an extensive track record in investing in Portugal.

João Baptista has always been fascinated by entrepreneurs and business, and ended up doings his Bachelor at NOVA SBE, one of the best business schools in Portugal, and his Masters at HEC School of Management in Paris, one of the top business schools in Europe, to pursue his dream of setting up his own company.

João’s professional career began in Germany, in the strategy department of a European space industrial conglomerate (Astrium). Due to his fascination over Chinese economic growth, João relocated to Beijing, where he met his Spark Capital business partner, Inês.

Within 2 years João was speaking mandarin fluently and elaborating his business plan to start Spark Capital. The Spark Group achieved 38 million Eur in sales in 2021 and more than 40 developed projects.

Gonçalo Mendes Leal

Founding Partner

NSMLawyers

Gonçalo is the founding partner ofNSMLawyers, a law firm dedicated to providing integrated legal services regarding the relocation of individuals to Portugal.

With over 20 years of experience, Gonçalo is responsible for managing thousands of golden visa applications in Portugal, together with a specialized team of 20 lawyers.

NSMLawyers is recognized worldwide as one of the top immigration law firms in Portugal, assisting clients from 187 nationalities. The firm dedicates to golden visa, D7, digital nomad, tech visa, and all types of residency in Portugal.

Duarte Calheiros Menezes

Fund Manager & Partner

BlueCrow Capital

Duarte is currently a partner and fund manager at Bluecrow Capital, which he joined in 2014. With over fifteen years of experience in the financial sector, he is specialized in asset structuring and management, with extensive knowledge in venture capital and private equity fund management.

Duarte concluded his degree in economics and master’s in finance at Católica Lisbon School of Business & Economics, one of the best business schools in Europe, and acquired experience in futures and options trading throughout the first five years of his career, working in large companies like OSTC Group.

As an investment professional, had the privilege of achieving consistent results over the years, drawing upon his asset and risk management expertise, he strives to navigate volatile markets diligently, identifying opportunities that benefit clients and minimize risks. Since 2018 as a fund manager, Duarte has been fortunate to provide leadership that has exceeded performance targets, delivering impressive returns through well-tailored strategies, and contributing to notable growth and optimization of portfolios.

Since 2020 led a massive fundraising campaign for the Bluecrow Growth Fund and Innovation Fund Series, which raised an impressive sum of more than €100 million, he also led the establishment of critical operational functions for BlueCrow Capital, which simultaneously involved the creation of onboarding procedures that streamlined the process of raising new investors, ensuring the smooth running and performance of the investor relations department, always taking into consideration the process established by the legal department, ensuring compliance with regulatory standards and ethical practices.

Mark Roberts

Senior Vice President

Western Alliance Bank

Mark Roberts is a senior vice president at Western Alliance Bank. Western Alliance Bank, headquartered in Phoenix AZ, is a publicly traded bank with over $65B in assets. Over his 13 years at the bank Mark has been appointed by the U.S. Secretary of Commerce to serve on the U.S. International Trade Finance Advisory Counsel, has sat on the boards of Global Ties U.S., a non-profit organization that promotes international student exchange programs, and the Phoenix Committee on Foreign Relations, an organization dedicated to providing forums that explore critical foreign policy issues and building enduring international connections. Mark has also served as the treasurer for the Arizona District Export Council and served as the Co-Chair of the Banking Committee for Invest in USA, the national trade association for the EB-5 Regional Center immigration program.

Mark and his colleague, Lisa Alberti, understand the evolving geopolitical landscape has made global banking more challenging. Together they have resolved to create an easier path for global companies and family offices to establish U.S. banking relationships to facilitate business activities in the U.S. and beyond. By taking the uniquely different approach of viewing compliance as a competitive advantage, Mark and Lisa have developed a system that makes opening accounts and banking in the U.S. easier for qualified global organizations. Through Western Alliance Bank’s Global Markets team, Mark and Lisa facilitate the corporate treasury needs of global business operations including foreign exchange currency payments, foreign exchange hedging, and letters of credit.

Krista Victorio

Managing Partner

Orience

Krista Victorio is a Managing Partner at Orience, a specialist in the Spain and Greece residency by investment programs. Orience covers all aspects of the client journey within its full-service team, including an in-house legal, tax, processing, asset search, and property management team. Having pursued the Spanish “golden visa” program herself, Krista brings unique insights to the table, fusing both personal and professional experience to advise both clients and partners on all aspects of the process. Krista obtained a Master of Accounting from USC in Los Angeles and an MBA from IESE Business School in Barcelona. Orience has offices in Barcelona and Madrid, and soon to be Valencia and Malaga.

Ricardo Cambra La Duke

Founding Partner

CLD Legal

With 24 years of experience, Ricardo is an expert in Corporate Structures, Private Interest Foundations, Tax and Estate Planning, Real Estate Investments, Asset Protection, Immigration, and Foreign Investment.

He currently successfully advises domestic and international companies, individuals, and families from multiple sectors, in the protection of their businesses and assets from legal risks, while investing, migrating, or growing their businesses in Panama.

Also, has a track record advising multinational personnel, and international investors on investment opportunities, visa processes, and the design of personalized solutions to ensure a successful transition to a new business and life in Panama.

Furthermore, Ricardo Cambra has extensive experience in various commercial concerns, including contract drafting and negotiation, corporate governance assistance, intellectual property, structuring and management of complex corporate restructuring, and representing sellers and purchasers in multiple commercial transactions. He has also worked with litigation counsels to assist clients in effectively and promptly resolving various commercial and family disputes.

He holds an LL. B., from Santa Maria La Antigua University (Panama); Superior studies in International Tax Law, Maastricht University (The Netherlands) and has completed multiple local and international programs organized by International Legal Training (New York), International Tax Planning Association, International Bar Association, IBFD in Amsterdam, Society of Trust & Estate Practitioners and the American Bar Association, on international transactions, tax planning, due diligence, asset protection, among many others.

Tomás Castro de Sá

Investment Professional

Oxy Capital

Tomás is a Senior Associate on the investment team, Head of Oxy Capital Real Estate Strategy, and sits on the Investment Committee.

His transaction experience as a member of the Growth & Buyout investment team includes multiple deals in diversified sectors, including the most successful transaction of Fund I. Since 2021, Tomás has been also leading the fundraising and execution efforts of Oxy Capital’s real estate dedicated fund, having raised capital mostly from a diversified base of US private investors.

Before joining Oxy Capital in 2017, he worked as a Summer Business Analyst in the Financial Sponsors team at Kearney.

Tomás holds a master’s degree in Finance from the London School of Economics and a bachelor’s degree in Economics from the Nova School of Business and Economics.

Guilherme Valadares Carreiro

Investment Professional

Oxy Capital

Guilherme is a Principal on the investment team, Head of the Golden Visa Initiatives, and sits on the Investment Committee.

His transaction experience as a member of the Growth & Buyout investment team includes more than 10 deals in diversified sectors. For 2 years, Guilherme also played a crucial active role in the operational and financial restructuring process of an Industrial company with +€250 Min Revenue. Since 2022, Guilherme has been leading the fundraising and execution efforts of Oxy Capital’s Golden Visa Funds (+60M€), having raised capital mostly from a diversified base of US private investors.

Before joining Oxy Capital in 2018, he worked as a Consultant for c.2 years as an Operational Consultant on the leading operational consulting firm in Europe, Kaizen Institute.

Guilherme holds a master’s degree in Industrial Engineering and Management from the Faculdade de Engenharia da Universidade do Porto (Portugal) and Technische Universität München (Germany).

Adhar Srivastava

Founder and Chairman

International Merchant Bank Limited

Adhar Srivastava is the founder and Chairman of the Board of the International Merchant Bank Limited, an International Bank located in Nevis, St. Kitts and Nevis. International Merchant Bank Limited provides corporate banking, private banking, and trade finance services to clients worldwide. Mr. Srivastava is responsible for the overall strategic direction, growth, and safety of the Bank. He has developed critical correspondent relationships for the bank and empowered his management team to succeed.

Mr. Srivastava is also the owner of Surya Capitale Securities, a FINRA and SIPC registered broker-dealer with having head office on Wall Street in New York. He is also the owner of Soleil Motors SRL is a luxury sportscar manufacturing company based in Milan, Italy.

Mr. Srivastava holds an undergraduate degree from NYU in Philosophy and an Executive MBA from Columbia University, London Business School, and Hong Kong University. He is also ICC-certified in UCP 600 and documentary collections and is ACAMS-certified. He is based in NYC.

Jeffery Hadeed

Chairman of the Board

Antigua Citizenship Investment Unit

Ambassador Jeffery Hadeed, a dynamic entrepreneur hailing from Antigua & Barbuda, serves as a driving force in various fields. Appointed Chairman of the Board for the Citizenship by Investment Programme of Antigua & Barbuda and non-resident Ambassador to Italy, Hadeed embodies an unwavering commitment to progress.

With a career spanning 38 years, Hadeed’s versatile ventures underscore his enterprising spirit. His achievements include the establishment of seven thriving restaurants and engagement in diverse sectors encompassing marine sales and service, fashion, manufacturing, imports, and distribution. As a registered Agent for the CIP, he has evolved into a property development and management maven, curating an impressive villa estate portfolio that includes properties owned by esteemed fashion icon Giorgio Armani. A standout accomplishment is the creation of the South Point Antigua, an avant-garde 23-unit boutique condo hotel nestled in the historic enclave of English Harbour.

Educated at the University of Florida, Hadeed graduated with a degree in Business (Marketing). He further enriched his expertise by delving into fashion design at Milan’s prestigious Istituto Marangoni. Fluent in English and Italian, he commands a versatile linguistic arsenal, extending to French and Arabic, and has traveled to more than 40 countries.

Hadeed’s journey exemplifies an individual who continually bridges cultures, sectors, and languages. His tenacity and acumen make him a pivotal figure in the landscape of entrepreneurship, investment, and diplomatic relations.

Timur Sitdikov

Founder and Managing director

World Talents

Timur Sitdikov is a founder and managing director at World Talents. With over 10 years of experience in investment migration service, he has supported 100+ HNWIs from various regions looking to move and invest in foreign jurisdictions. Timur strongly believes that by transferring knowledge and talent across the globe and centers of innovation and by providing researchers and startup founders with the necessary resources, he and his team create economic opportunities and benefit society. Timur works closely with universities, R&D institutions, and designated organizations to facilitate the immigration of talented people and startups to Canada, the US, the UK, Cyprus, France, Portugal, and other popular destinations. Having an extensive background in international investment migration and tax law, Timur carefully guides his clients through the world’s innovative landscape and helps local businesses thrive globally. He consulted various investment organizations and helped more than 100 clients, their families, and businesses move to places that are more suitable for achieving their goals and contribute to the development of global startups and R&D.

Antonio Guerreiro

Executive Director

Algarve Evolution

Through his commitment to effective communication and collaborative partnerships, Antonio Guerreiro has been building strategic bridges between tech startups, top talent, and visionary investors.

He is a versatile and forward-thinking professional with a unique combination of experience in implementing and managing projects both in the technology and innovation space (PT) and in the entertainment (USA) and hospitality (UK) industries.

Since 2015, Antonio has been connected to the Portuguese startup ecosystem, as co-founder of a startup, and a member of ideation and acceleration programs and national competitions as a participant, mentor, and jury.

Rogelio Carrasquillo

Managing Shareholder

Carrasquillo Law Group P.C.

Rogelio “Roy” Carrasquillo is the Managing Shareholder of Carrasquillo Law Group and Chair of its EB-5 Immigrant Investor Program Services and Compliance and Securities Practices. He has been providing strategic guidance and advice to clients in a variety of complex and sophisticated legal transactions for over 20 years.

Roy represents public and private clients using EB-5 as a source of capital, filing for EB-5 Regional Center designation, investors evaluating their options at the redeployment stage, as well as developers seeking to raise capital using the EB-5 Program. He is experienced with public-private partnership projects using EB-5 funds, Opportunity Zones and Tax Credits.

Roy graduated from Georgetown University and the University of Pennsylvania Law School. and is admitted to practice in New York and Puerto Rico.

Diego Ortiz de Zevallos

Deputy Administrator

ProPanama

As a graduate of Panama’s Santa Maria la Antigua University (USMA) with a Bachelor’s Degree in Law and Political Science, he holds numerous specializations, including in Business Creation from the University of Louisville (Panama), International Relations and Negotiations from the University of Palermo (Argentina), International Trade from George Washington University (United States), and Project Management and Design from the Organization of American States (OAS).

Before occupying his actual position as Executive Deputy Director of PROPANAMA, Mr.Ortiz de Zevallos was the lead advisor in the Office of the Vice Minister of Foreign Relations of the Republic of Panama. During his professional career, he has worked as a lawyer at Zúñiga & Associates, specializing in international trade law.

With experience in both the public and private sectors, as well as in trade law, international relations, regional integration, legal advisory, and business administration, Mr. Ortiz de Zevallos has served as Chief of Staff of Panama’s Vice Ministry of Foreign Relations, Deputy Director of International Economic Relations at the Ministry of Foreign Affairs and Economic and Legal Advisor in the Embassy of Panama to the Organization of American States (OAS), where he worked on several Committees, including on Inter-American Summit Management and Civil Society Participation in OAS Activities, Administrative and Budgetary Affairs, Migration Issues, and Legal and Political Affairs.

Mr. Ortiz de Zevallos has been appointed Ambassador Extraordinary and Plenipotentiary on special missions and has been Panama’s representative in multiple assemblies and meetings before the OAS, the UN, the Central American Integration System (SICA), the Association of Caribbean States (ACS), the Community of Latin American and Caribbean States (CELAC), in addition to participating in various international missions and high-level bilateral meetings held with other States.

Madalena Monteiro

Lawyer

NSMLawyers

Madalena is a Lisbon-based immigration attorney with extended experience in immigration planning and assistance to HNWI in Portugal.

Together with NSMLAWYERS, Madalena is responsible for almost a thousand Golden Visa applicants worldwide. Madalena takes care of the processes from A to Z.

Rahim Lakhani

President and CEO

The Lakhani Group

As a nuclear engineer, he has extensive experience in managing all aspects of large-scale power plant projects, including project coordination, design, and construction execution. In addition, he has taken on the role of investor, focusing on distressed assets and restructuring companies in the operations stage, leading them to become profitable ventures. He holds a Degree in Engineering from the prestigious University of Waterloo in Canada, where he gained a strong foundation in engineering principles and practices.

To complement his engineering background, he has also pursued certifications in the field of finance, obtaining certification in Marketing of Credit to Consumers, Marketing of Mortgage Credit, and Credit Intermediation and receiving licensing with the Bank of Portugal. These credentials demonstrate his proficiency in various aspects of finance and his ability to provide valuable insights and guidance to clients seeking financial advice.

Beyond his professional accomplishments, he has also been actively involved in his community, serving as the past Chairman of the Jubilee Real Estate Alliance in Ontario, Canada. Through this role, he has gained valuable experience in community engagement and leadership, further enhancing his ability to connect with people from all walks of life.

Overall, his diverse range of experiences and expertise make him a valuable asset to any team or project and his dedication to excellence and commitment to lifelong learning ensures that he is always striving to improve and stay ahead of the curve in his field.

Matthew Rappaport

Vice Managing Partner

Falcon Rappaport & Berkman LLP

Matthew chairs FRB’s Taxation and Private Client Groups. He concentrates his practice in Taxation as it relates to Real Estate, Closely Held Businesses, Private Equity Funds, Family Offices and Trusts & Estates.

He advises clients regarding tax planning, structuring, and compliance for commercial real estate projects, all stages of the business life cycle, generational wealth transfer, family business succession, and executive compensation. He also collaborates with other attorneys, accountants, financial advisors, bankers, and insurance professionals when they encounter matters requiring a threshold level of tax law expertise.

Matthew is known for his work on complex deals involving advanced tax considerations, such as Section 1031 Exchanges, the Qualified Opportunity Zone Program, Freeze Partnerships, Private Equity Mergers & Acquisitions, and Qualified Small Business Stock.

He has served as a trusted advisor for prominent real estate funds, executives of multinational corporations, venture capitalists, successful startup businesses, ultra-high net worth families, and clients seeking creative solutions to seemingly intractable problems requiring tax-focused analysis.

Jeffrey Verdon

Falcon Rappaport & Berkman LLP

Jeffrey Verdon is the Chair of the Asset Protection Planning Group at Falcon Rappaport & Berkman LLP, a NY based full-service law firm. Jeffrey is based in the Newport Beach, CA office, whose practice is focused on integrated estate planning with asset protection for affluent families and successful business owners. Jeffrey is the author of Estate Planning for Women Only, now in its 4 th edition; a regular speaker to professional organizations and financial conferences and has published over 25 articles with Kiplinger.com and a regular contributor to the Orange County Business Journal.

Zaher Fallahi

Tax Attorney and Founder

Law Offices of Zaher Fallahi

Zaher Fallahi, Attorney, CPA, is the founder of the Law Offices of Zaher Fallahi. He worked in private industry, prominent professional firms, and a major government agency before opening his own practice in 1992. Zaher is closely associated with other tax, business, and estate planning lawyers and has offices in Los Angeles and Orange Counties.

The firm represents clients nationwide before the IRS, IRS-Criminal Investigation, Financial Crimes Enforcement Network (FinCEN), and the US Treasury’s Office of Foreign Assets Control (OFAC) with respect to Domestic & International Taxes, Report of Foreign Bank and Financial Accounts (FBAR) and Foreign Account Tax Compliance Act (FATCA), Foreign Gifts, Foreign Inheritance, Cryptocurrency Tax, Offer-In-Compromise, Transfer of Money from overseas from Legal, Tax and Anti-Money Laundering viewpoint.

Zaher has testified before the court on tax and legal matters as an expert witness. He advises trial lawyers on tax-exempt status of their awards and tax deductibility of their losses under the tax law. Zaher has been recognized as a top tax attorney.

Adding {{itemName}} to cart

Added {{itemName}} to cart